The Federal Reserve’s Flawed Foundation: A Constitutional and Historical Re-examination

December 13 | Posted by mrossol | American Thought, Debt, US Constitution, US DebtA sorry situation brought on be men of much less character than our founding fathers. All about current gratification vs long-term stability; and the never-ending effort to deflect responsibility when things get uncomfortable. mrossol

Source: The Federal Reserve’s Flawed Foundation: A Constitutional and Historical Re-examination

Author’s Note: The following summary presents the principal arguments of a nineteen-page manuscript grounded in more than thirty-five primary authorities, judicial decisions, and peer-reviewed studies. It is a culmination of 4 years of study, which is currently being submitted to several law review journals and preprint repositories.

If you find this publication helpful, please share it with your peers.

What is true patriotism? Is it the quiet acceptance of the status quo, or is it the courage to hold our most powerful institutions accountable to the document that gave them life: the Constitution of the United States?

The Founding Fathers, in their wisdom, understood that financial sovereignty was inseparable from political liberty. They risked their lives to build a nation governed by laws, not by the whims of a distant, unelected elite. In plain English, they wrote into Article I, Section 8 that Congress—and Congress alone—shall have the power “To coin Money, [and] regulate the Value thereof.”

They did not provide an exception clause. They did not authorize a future Congress to delegate this sacred, sovereign trust to a quasi-private banking cartel.

To ask whether the Federal Reserve is constitutional is therefore not an attack on America. It is the most American question we can ask. It is an act of fidelity to the Republic the Founders envisioned and a defense of the economic liberty they fought to secure.

This is not a story of left versus right. It is a story of the Constitution versus an institution that has operated outside its clear boundaries for over a century. Before we can debate the Fed’s policy, we must first answer a more fundamental question: by what authority does it exist at all?

My new, 19-page scholarly article, “The Federal Reserve’s Flawed Foundation,” is not just an economic analysis. It is a constitutional audit. It is an invitation to every American who believes our founding principles are more than just words on parchment to examine the evidence and decide for themselves.

Because defending the Constitution is the highest form of patriotism.

The Question No One is Asking

The Federal Reserve System, the central bank of the United States, wields a power over the economic life of the nation that is arguably unparalleled by any other government or quasi-government entity. Its decisions on interest rates, money supply, and bank regulation have profound and immediate consequences for every citizen. Yet, for an institution of such immense power, it has been the subject of remarkably little rigorous constitutional scrutiny from the judiciary and mainstream legal academy. While its policy actions are debated, its foundational legitimacy is often taken for granted. This publication takes aim at the roots of that legitimacy, arguing that the Federal Reserve System, in its current form, is built upon a constitutionally flawed foundation.

The Core Argument: An Unconstitutional Delegation of Power

This Article’s core contention is that the Federal Reserve Act of 1913 represents an impermissible delegation of an exclusive legislative power—the power to “coin Money, [and] regulate the Value thereof”¹ —to a quasi-private entity. This structural defect renders the entire apparatus constitutionally suspect. In making this argument, this Article adopts a methodology analogous to the rigorous separation-of-powers analysis employed in cases scrutinizing delegations of quintessentially sovereign functions. It draws upon original constitutional design, early monetary statutes, and contemporaneous debates surrounding the nondelegation doctrine, emphasizing that powers touching the nation’s monetary sovereignty were historically regarded as uniquely nontransferable.

The Evidence: Three Pillars of a Flawed Foundation

Pillar 1: The Constitutional Flaw

- Original Intent: The Framers vested the monetary power exclusively in Congress, the branch most accountable to the people. They viewed it as a sovereign function that could not be outsourced.

- Nondelegation Doctrine: Congress cannot delegate its legislative powers without an “intelligible principle.” The Fed’s vague mandates (“maximum employment, stable prices”) fail this test, granting it virtually unchecked discretion.

- The 1913 Trilogy: The Federal Reserve Act, combined with the 16th (income tax) and 17th (direct election of Senators) Amendments, created a structural transformation of the American constitutional order, centralizing power in a way the Framers never intended.

Pillar 2: The “Privately Owned” Paradox

- Hybrid Structure: The Fed is a strange hybrid—part public, part private. Its regional Reserve Banks are legally owned by private member banks.

- The Judicial Admission: In Lewis v. United States (1982), a U.S. Court of Appeals made a dispositive finding: “The Reserve Banks, as privately owned entities, receive no appropriated funds from Congress.”²

- The Constitutional Paradox: How can a “privately owned entity” wield a sovereign legislative power? This arrangement violates the most basic principles of democratic accountability and the separation of powers.

Pillar 3: A Century of Failure

If the Fed’s structure is constitutionally suspect, has its performance justified its existence? The data says no.

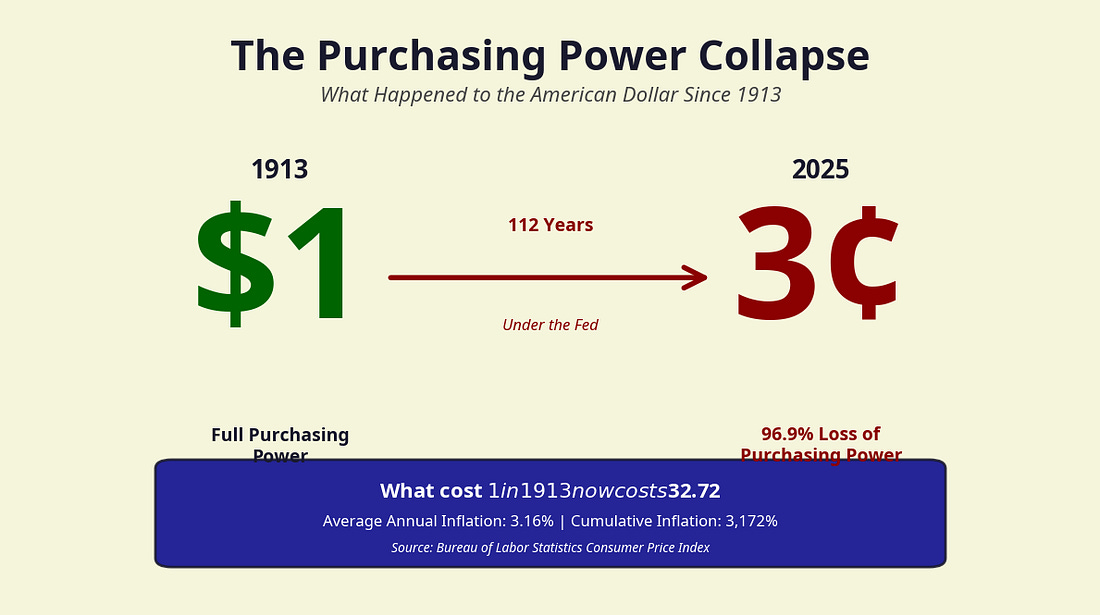

- 96.9% Purchasing Power Collapse: Since the Fed’s creation, the U.S. dollar has lost 96.9% of its value. What cost one dollar in 1913 costs over thirty-two dollars today. This is not stability; it is a slow-motion hyperinflation.

- 14,545x Faster Debt Growth: In the 123 years before the Fed, the national debt grew by an average of $23 million per year. In the 112 years since the Fed, it has grown by an average of $336 billion per year—a 14,545-fold acceleration.

- Boom-Bust Cycles: Far from preventing financial crises, the Fed’s manipulation of interest rates creates the very boom-bust cycles it is supposed to prevent, from the Great Depression to the 2008 financial crisis and beyond.

The Scholarly Debate

Even the Fed’s defenders in the legal academy acknowledge the “surprising degree of doubt” about its constitutionality. The Article engages with the leading scholarly arguments, including:

- The Originalist Defense: (Chabot, Notre Dame Law Review)

- The Alternative Grounding: (Huq & Galle, University of Chicago)

- The Legitimacy Framework: (Binder & Skinner, Stanford Journal of Law, Business & Finance)

By engaging with these perspectives, the Article demonstrates that the Fed’s legitimacy is far from settled, even among mainstream scholars.

A Foundational Shift in Sovereignty

The Federal Reserve Act represents a foundational shift in the locus of monetary sovereignty—from the elected representatives of the people to a quasi-private banking cartel. This constitutional flaw is not merely theoretical; it has had profound and destructive empirical consequences.

The time has come to take seriously the constitutional questions that have been ignored for too long and to ask whether an institution so demonstrably flawed in both its structure and its performance can be allowed to continue in its present form.

Leave a Reply

You must be logged in to post a comment.