Looks Desperate: Trump Threatens Countries Who Sell Their US Bonds

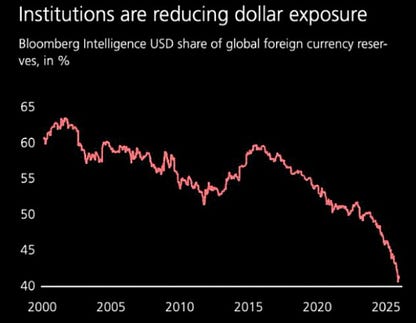

January 24 | Posted by mrossol | American Thought, Debt, Economics, USD, WauckI confess I am clueless about may of Trumps actions. Trying to arm-twist nations about their actions relative to their economic decisions is stupid in my opinion. Trying to protect the dollar as the world’s primary. currency with threats will end badly. As with any thing, eventually people or markets have alternative choices. Especially as the world shifts to “multi-polar” there will be other alternatives for where people, countries, economies put their capital. What we are seeing with Gold and Silver should be a wake-up call to the administration. mrossol

Source: Looks Desperate: Trump Threatens Countries Who Sell Their US Bonds

Data points to add to the transcript of Sean Foo’s take on the crazy Davos get together:

The Kobeissi Letter @KobeissiLetter

2h

President Trump 8 Days Ago: “If Canada can get a trade deal with China, they should do that.”

President Trump Today: “If Canada makes a deal with China, it will immediately be hit with a 100% tariff.”

One way or another, threatening people who sell down their US bond holdings doesn’t look good and has long run implications that go far beyond just smacking Scandinavian countries around.

US Threatens Global BOND DUMPERS, Bessent Iran Currency Collapse, Gold Humiliates USD

It’s Friday and things just got crazy again. How do you know when the empire is in trouble? It’s when you drop diplomacy. You stop cooperation and you begin fighting the world. The Davos summit was a roller coaster. We had Trump demand Greenland and then back down because the markets were collapsing. But he still demanded a bizarre Greenland framework with NATO. It would mean a forever military presence on the territory without limits to build the golden dome missile defense to counter the phantom threats of China and Russia. In addition, Trump wants the wealth under Greenland. The US wants mining rights to the rare earths, fossil fuels, and precious metals under the ground. Once again, it’s to prevent the Russians and the Chinese from getting there first—notwithstanding the insane amount of mining costs. These demands might just fall through. Mark Rutte has no mandate to give up Greenland or meet the terms. It’s up to Denmark. Plus, does the US have enough money to set up defense and mining facilities on such a harsh frozen tundra? Trump’s big gambit in Davos might just fall through.

Europe is going to play the delay game with Trump and hope the floor collapses during the US midterms. In Asia, we call this Tai Chi.Europe is going to play the Tai Chi game of delay and prey. Meanwhile, the US is getting terrified over the world dumping US treasuries. Now, we saw Bessent telling bond holders to chill and not fight back against US actions. Trump is doubling down on a message: do not sell US assets or else Washington will strike back.

Maria B: This EU anti-coercion instrument that would be, you know, services impacting our services, as you said. And then the Danish pension fund said that they’re going to exit US treasuries, $100 million uh treasuries at the end of December. European countries hold trillions of uh stocks and bonds from the US. Do you worry that they would start selling those in retaliation?

Trump: If they do, they do. But, you know, if that would happen, there would be a big retaliation on our part. And we have all the cards.

Now, this is crazy. It really goes against free markets. The whole world including Europe is obligated to buy and hold US assets? If we dare to sell Treasury bonds and stocks, will Trump really retaliate? Now, he said the US holds all the cards. He probably means sanctions and tariffs, most probably imposing tariffs on countries that dare to dump their US treasuries. Worst case scenario, he might even go after private institutions with dollar sanctions. Now imagine a pension fund getting cut away from the US dollar system for selling US bonds! This is next level financial upheaval. We are seeing the Trump administration getting really desperate to protect the dollar system.

That’s the real bottom line. Trump said, near the beginning of his second term, that he would go to war to defend King Dollar—which is the true basis for the Anglo-Zionist Empire. We’re seeing something like that playing out.

We’ve said this before–this will be the endgame, and it’s a clear sign of the US losing control. Foreigners own up to 32% of total US public debt. That’s around 8.5 trillion in treasury bonds, which is an enormous amount. If we throw in private investment funds and pension funds, the amount would be well over 10 trillion. Even a partial dump just from Europe and China would devastate the US economy. It would break apart the bond market and cause yields to fly to the moon. The world is really getting tired of giving Washington an endless credit card funded by global savings. It’s one thing if the credit card is used responsibly, but it’s being used to build a military and economic system to threaten the world.

1+1= 2. Trump said he’d go to war to defend King Dollar. Now he wants to up the “defense” budget from $1T to $1.5T.

During the summit, Bessent swatted away claims of Europe selling off US bonds. He called the dumping of bonds by the EU irrelevant. Yet he was concerned about an analyst report from Deutsche Bank about Europe dumping treasuries. So which is it? Is the US concerned or are they not concerned? Well, one thing’s for sure, it’s not just China, Russia or BRICS that’s de-dollarizing. EU countries are exiting the dollar right under Bessent’s nose. At a peak, the Danes were holding nearly $25 billion in US Treasury bonds. But things are changing. Since 2016, they started selling their stash. They are no longer net buyers. Look at the big drop over the past 12 months. They dumped over $4 billion since Trump took office. Kind of tells you the level of confidence they have with US economic policy. And it was a smart decision. They escaped collapsing Treasury values plus the massive dollar devaluation last year. they didn’t have to endure a 10% crash relative to their own currency.

Now, if more EU countries start to exit Treasury bonds, this will be a big problem for the fiscal situation of the US. It will be a disaster for the national debt that requires interest rates to come down. Europe holds over 8 trillion in US debt and stocks. Even Greenland’s pension fund is thinking of divesting. If this gets dumped, prices would collapse. But not just prices. There will be a stigma for a very long time attached to bankrolling the US government. And that’s why Trump’s threat is not a very wise one.

In the first two quarters of 2026, the US government is going to borrow $1.1 trillion from the markets. That is $158 billion more versus last year in 2025. Despite the tariff income, the US still needs to borrow money. That is what happens when Trump wants to expand the military like no tomorrow. If the world continues to dump Treasury bonds, this is obviously going to be a problem. The US is already borrowing money at 4.2% on a 10-year. Central banks normally hold longer duration bonds. If this gets sold, it doesn’t matter how low the Fed cuts interest rates. We could see long-term rates flying to the moon. Not only will this destabilize the real economy, it will push the national debt closer and closer towards default. Yet Scott Bessent is defiant and just dismissed Europe. He believes they don’t have the guts or they don’t have any options to retaliate. Now is peak hubris, the pride before the fall.

Q: Just to follow up on that. So you do not believe that the EU or the UK have any retaliatory financial instruments or measures in their bag that the United States should be worried about?

Bessent: No.

But let’s look at things from the perspective of the bond holders, especially those in Europe. What will happen if Brussels orders a dump, or individual countries like Denmark continue to sell? After what we’ve seen from the tariffs and Venezuela, nothing is truly off the table. Even though it might be bad for the US economy, Trump might still impose financial punishments. Major banks are already putting this down as a legitimate risk. The US could indeed sanction Treasury holders in Europe who dare to sell. It’s not impossible and it will be quite devastating. These financial sanctions could include locking entities out of the US financial system. So, no using Swift or transacting with American banks. US companies could also be forbidden from trading with them. And, yes, the classic asset freeze. Just like Russian or Iranian assets, EU money could also get frozen. So Treasury bonds could get put on ice indefinitely.

Now, of course, this will be a horrible miscalculation. The US might get to lock in trillions of EU money and prevent a liquidation event. But what about future sales? Even if Washington uses up all the $3.6 trillion to fund the government, the money will run out sooner or later–within five or six years at the very most. Who will dare to buy treasuries in the future? This seriously won’t end well. And for bond holders and central banks, not buying US bonds is not the end of the world.

It’s really time for them to take a page out of the Chinese and the Russian playbook. It’s time to look at gold. Despite the seizure of Russian assets, their central bank had ample gold reserves. And because of the price rally, Russia’s reserves have gained a whopping $216 billion. That is almost enough to make up for the entire amount of US bonds frozen in 2022. The Kremlin positioned themselves to win and they diversified their holdings enough. It’s something the EU has to do–and probably will start doing very soon. There’s a reason why Poland is one of the biggest recent buyers of gold and why the Germans have been taking the gold back home as well. There’s no counterparty risk holding gold. And as gold stackers and investors, we all know the good old phrase, if you don’t hold it, you don’t own it. China and Russia understand this and the EU, well, they’ll have to learn that lesson pretty fast.

In January, Russia’s total reserves hit $755 billion. That is a lot of money for a country under 10,000 sanctions. Now, look at the amount of gold they hold. Almost $330 billion worth. Since 2022, Russia’s foreign currency assets have been decreasing. Part of it is to fund the war effort and part of it is fluctuating bond values, but the value of their gold holdings has more than made up the shortfall. It’s now half the amount of total reserves. The Russian finance ministry also expects gold to keep climbing and to surpass $5K an ounce. The justification is straightforward. A loss of confidence in the global reserve currency. And that’s just Russia. We already know China’s situation as well. Their central bank is buying. The Chinese military is also buying and many other banking entities are stockpiling. Now that Europe has gotten a memo from Trump, we have another potential tail wind for gold.Prices in the next 5 to 10 years could really go ballistic. The idea of $10,000 gold per ounce is no longer impossible. In fact, it is within our lifetime. As of this recording, the price of gold is above $4,900. In fact, it’s $4,950 now.

Now, when I sang the Christmas song of $5,000 gold, I never ever expected it to come that fast. It’s hardly a month, and we are just one or 2% away from gold hitting $5,000. This is insane. But it’s not a coincidence. This is what happens when the world starts to lose faith in the dollar and treasury bonds. Trump threatening US asset holders will only make things worse. The world has to look for other places to put their money in. Guys, for crying out loud, even silver is almost at $100 an ounce. The threat of US sanctions is really concerning here. It will cause bond holders, both private and public, to divest just to stay safe. During the Davos summit, Bessent himself outlined how US financial sanctions worked. He bragged about how it caused a massive dollar shortage in Iran. It’s really a warning to all nations to be aware of the risk.

Bessent: I said that I believe the Iranian currency was on the verge of collapse. That if if I were an Iranian citizen, I would take my money out. President Trump ordered Treasury and our OFAC division, Office of Foreign Asset Control, to put maximum pressure on Iran. And it’s worked, because in December, their economy collapsed. We saw a major bank go under. The central bank has started to print money. There is a dollar shortage. They are not able to get imports. And this is why the people took to the street. So this is economic state craft. No shots fired.

Big powers will always impose sanctions in one form or another. It’s what they do. But the US is no longer putting up a pretense. They are done with the song and dance. This doesn’t change the effects of the sanctions, but they are still damaging. It does however change how countries respond to it, because there can be no denying that the US is aware of the consequences. And this is something we have talked about since the Biden sanctions. The moment Swift and the dollar was weaponized, it was effectively game over. The world saw the iron fist, except this time there wasn’t even a velvet glove. Even if I want to pretend US sanctions are based on a rules based order, I can’t. It’s about creating a dollar shortage to destabilize foreign currencies. The only way to counter this is for countries to be less reliant on the dollar. It’s a really [?] obvious moment.

Now, Goldman has raised their gold forecast to $5,400 an ounce. They bumped it by a whopping $500 in just one revision. Normally, it would be quite an ambitious leap, but so far Goldman has been right. Just a quick note, people have been asking me how I’m allocating, and I’ll keep it quite simple. I’m still long gold, but this time I’m adding even more international stocks, and that includes positions in Brazil and Canada. And I put my money where my mouth is. Could the US stock market grow? Sure, it can. A bubble can always inflate bigger, but I believe the rest of the world will take off faster than the US. Trump has managed to turn the US into the Galactic Empire, and the rest of the world is now suddenly the Rebel Alliance. It’s just so bizarre. We are deep in the Twilight Zone, and this timeline is truly wow.

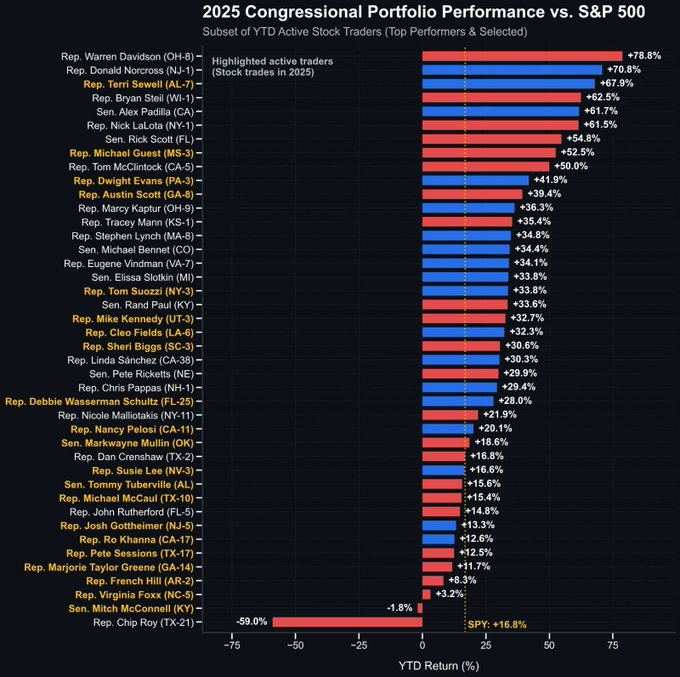

So while all this is going on, I’m glad you asked what Congress has been up to in 2025. MAGA people will delight to learn that Dems were losers—along with most Americans who want honest government:

Wow! How did Chip Roy beat the odds so bigly?

And for young people who can’t buy homes, this is what Trump had to say to the billionaires in Davos. He won’t abandon his Boomer voters:

And I have to say one thing about housing, because nobody ever says this. I am very protective of people that already own a house, of which we have millions and millions and millions. And because we have had a such a good run, the house values have gone up tremendously. And these people have become wealthy. They weren’t wealth, they’ve become wealthy because of their house. And every time you make it more and more and more affordable for somebody to buy a house cheaply, you’re actually hurting the value of those houses, obviously, because the one thing works in tandem with the other. And I don’t want to do anything that’s going to hurt the value of people that own a house, who, for the first time in their lives, are walking around the streets of whatever city they’re in, very proud that their house is worth $500-600-700,000.

Now, if I want to really crush the housing market, I could do that so fast that people could buy houses, but you would destroy a lot of people that already have houses. In some cases, they’ve mortgaged their house, and the mortgage would be very low, and all of a sudden, the mortgage, without any changes, becomes very high, and they end up losing the house. I’m not going to hurt. And I speak with Scott, who’s doing a fantastic job, and Howard, who’s doing a fantastic job, and all of my people, and I always say, ‘Look, you know, I can crush the hell out of the market. We can drop interest rates to a level…’ And that’s one thing we do want to do, that’s natural, that’s good for everybody.

Meaning In History is free today. But if you enjoyed this post, you can tell Meaning In History that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

Leave a Reply

You must be logged in to post a comment.