Briefly: SOFR; MAGA

November 9 | Posted by mrossol | Economics, Trump, US Debt, WauckHmm. There DO seem to be a lot of ‘negative’ signs the past month or so. mrossol

Source: Briefly: SOFR; MAGA – by Mark Wauck – Meaning In History

Briefly, because I personally have nothing much to add:

Shanaka Anslem Perera @shanaka86

THE WORLD’S MOST IMPORTANT NUMBER JUST COLLAPSED

November 6, 2025: SOFR crashed to 3.92%. The lowest level in two years. The benchmark that controls $397 trillion in global contracts just signaled something catastrophic.

This is not a rate cut. This is a liquidity flood.

THE NUMBER THAT MOVES EVERYTHING:

SOFR replaced LIBOR in 2023 as the foundation beneath derivatives, corporate loans, adjustable mortgages, and securities worth more than 15 times global GDP. When SOFR moves, $397 trillion in financial contracts reprice simultaneously.

It just fell from 4.22% on October 31 to 3.92% in six days. A 30 basis point nosedive that saves borrowers $50 billion annually but screams one word: panic!!

WHAT THE FED IS NOT SAYING:

The Federal Reserve cut rates 150 basis points year to date. Excess reserves are flooding repo markets. Overnight borrowing costs for the entire financial system collapsed to levels not seen since September 2023, when recession fears first surfaced.

Translation: The Fed sees something breaking and is throwing liquidity at it before the fractures become visible.

THE MECHANISM OF CONTAGION:

Lower SOFR slashes bank funding costs by 10 to 30 basis points immediately. Corporate loan rates drop 15 basis points. Adjustable rate mortgages reset 20 basis points lower, cutting monthly payments by $200 average.

Credit expands 2 to 5 percent. Lending accelerates. Asset prices inflate.

But here is what they are not telling you: sub-4% SOFR has preceded every major asset bubble since 2008. Cheap money does not fix broken growth. It masks it.

THE GLOBAL SPILLOVER:

Cheaper dollar funding triggers $10 billion plus in emerging market carry trade inflows. Currency volatility spikes. Foreign central banks hoard dollars. The cycle that destroyed Argentina, Turkey, and Sri Lanka restarts.

WHAT HAPPENS NEXT:

If Q4 GDP misses expectations or inflation spikes above 3.5%, SOFR reverses violently. Repo market seizures return. The 2019 overnight funding crisis replays at scale.

If the Fed holds course, credit bubbles inflate until something pops. Corporate debt. Commercial real estate. Equity multiples at 25x earnings.

THE TRUTH BURIED IN THE DATA:

SOFR is not just a rate. It is the early warning system for systemic stress. When the world’s most important number collapses this fast, it means central banks are terrified.

They are easing into a recession they cannot admit is coming.

Hold duration. Hedge via SOFR futures. Watch repo volumes like a seismograph.

The tremors started. The quake is next.

1:47 AM · Nov 9, 2025

Knowledgeable comments are invited, of course.

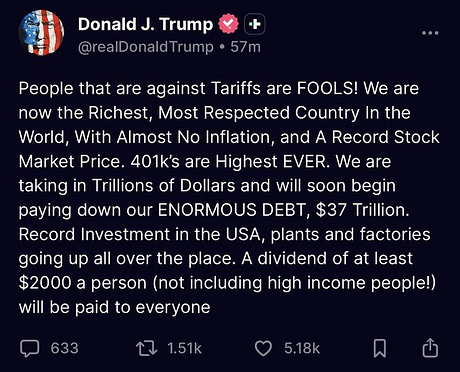

el gato malo discusses Trump’s chest thumping BS rhetoric about how he MAGAed with his tariff shock and awe. I’m with el gato malo—and the comments on the thread are interesting, too. As I reminder, here’s Trump:

i’m honestly not sure what to make of this new set of talking points. they seem disconnected from reality.

it feels like panic as the economy ex-AI is now obviously in distress.

spamming another ~$300bn round of covid checks will just set off another sugar high of inflation.

so will 50 year mortgages.

so will tariffs. (as they did in 2016)

manufacturing jobs have been decreasing for 2 years and the more rapid decrease since late year has not abated. trade wars do not create jobs.

and there is a zero percent chance we start paying down debt. we’re running structural deficits of $1.5-$2 trillion a year and this cannot be fixed without massive reform to entitlements because entitlements and interest costs on the debt alone are over $5 trillion and consume functionally all tax receipts before a dollar of discretionary spending is paid.

i’m honestly struggling to see what trump is playing at here. it feels like populist pandering calculated to set his economic credibility on fire.

does any serious human think the US federal debt level will be lower when trump leaves office than it is today?

because i’ll take the other side of that bet.

8:52 AM · Nov 9, 2025

Leave a Reply

You must be logged in to post a comment.