C&C. SVB Crisis. “We (you) Will Bail Them Out. More SADS.

March 13 | Posted by mrossol | American Thought, Biden, Big Govt, Childers, Debt, Democrat Party, Disinformation, Economics, Ruling Class, Western CivilizationSource: THE LATEST CRISIS ☙ Monday, March 13, 2023 ☙ C&C NEWS

🗞*WORLD NEWS AND COMMENTARY* 🗞

🔥 The biggest distraction today continued to be the sudden and unexpected failure of Silicon Valley Bank (SVB). The Wall Street Journal ran countless articles about the latest and greatest emergency, including one published online around 9pm last night headlined “SVB, Signature Bank Depositors to Get All Their Money as Fed Moves to Stem Crisis.”

Treasury operatives worked on the problem all weekend, so of course it got progressively worse, with Biden officials starting out the weekend promising there would be “no bailout” and by the end of the weekend promising that the government would make every SVB depositor whole, starting first thing Monday morning, at which time most depositors will probably continue yanking their money out before Biden changes his mind again, if they know what’s good for them, that is.

In between those opposing promises, Treasury announced, organized, and briefly held an invisible auction of SVB’s banking assets, in an effort to find a sucker, I mean a buyer, to take over the mess, sorry, I mean the opportunity. The “winner” was to be announced Sunday afternoon, but when Sunday afternoon rolled around, officials mysteriously stopped talking about the auction, and all reference to the auction vanished from corporate media faster than Fauci fled Washington after Republicans took the House.

So that was that. The only reference I found to the failed auction was this one line from an unrelated WSJ story:

Regulators struggled to find a buyer on Sunday and pivoted to backstopping the deposits, according to a senior Treasury official, as they sought to announce a resolution to depositors by Monday morning.

Whew! A blogger has to move fast these days, to keep up with all the Einstein-like intellects infesting the nation’s capital. Their brains move so much faster than everyone else’s. Or — as a possible alternative — they have no idea what they are doing and just lie all the time, take your pick.

Anyway, on Sunday afternoon the Treasury Department issued a statement intended to quiet the markets and solve every political problem of the Biden Administration with the stroke of a pen, in this case by whipping out the Nation’s checkbook and generously covering the cost of the second-largest bank failure in the country’s history:

[T]o support American businesses and households, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. This action will bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy.

On Sunday, the extra-busy Treasury Department took control of ANOTHER financial crisis, this time Signature Bank, which specialized in cryptocurrency speculation, I mean investments, and which was “reeling from a bet on crypto banking that foundered after the sector imploded and banking regulators cracked down on lenders’ exposure to digital assets.”

It’s nothing to worry about, everything is going swimmingly, or as the Wall Street Journal flatly described Signature Bank’s implosion:

The failure is the third-largest in U.S. history.

It was probably just bad luck. Don’t worry though, Signature Bank’s high-risk investor customers will also be fully guaranteed by free government money, I mean opaque government financial shenanigans, I mean calculated money moves that benefit everybody, especially YOU.

You’re welcome.

Great job, Joe! It is becoming increasingly obvious that the bizarre collapse of NSA-funded crypto-giant FTX and its flabby founder injected a problem now spreading like turbo-cancer throughout the foundering digital-currency market, a problem demanding a solution in the form of even more massive bailouts.

Soon we’ll need a new global currency to replace the hyper-inflated dollar. Thank goodness they’ve coincidentally been working on just such a solution. What would we do without government?

The usual bailouts arguments are predictably making the rounds, with folks pointing out Biden’s hypocrisy toward East Palestine’s non-politically-connected residents who got poisoned water instead of a bailout, versus the connected Big Tech investors who were mildly inconvenienced for 24 hours before Biden used YOUR MONEY to make them whole.

So in other words, the US taxpayer participates in the RISK of élite investments, but doesn’t get to share in the profits. It’s all downside for us, and all upside for them.

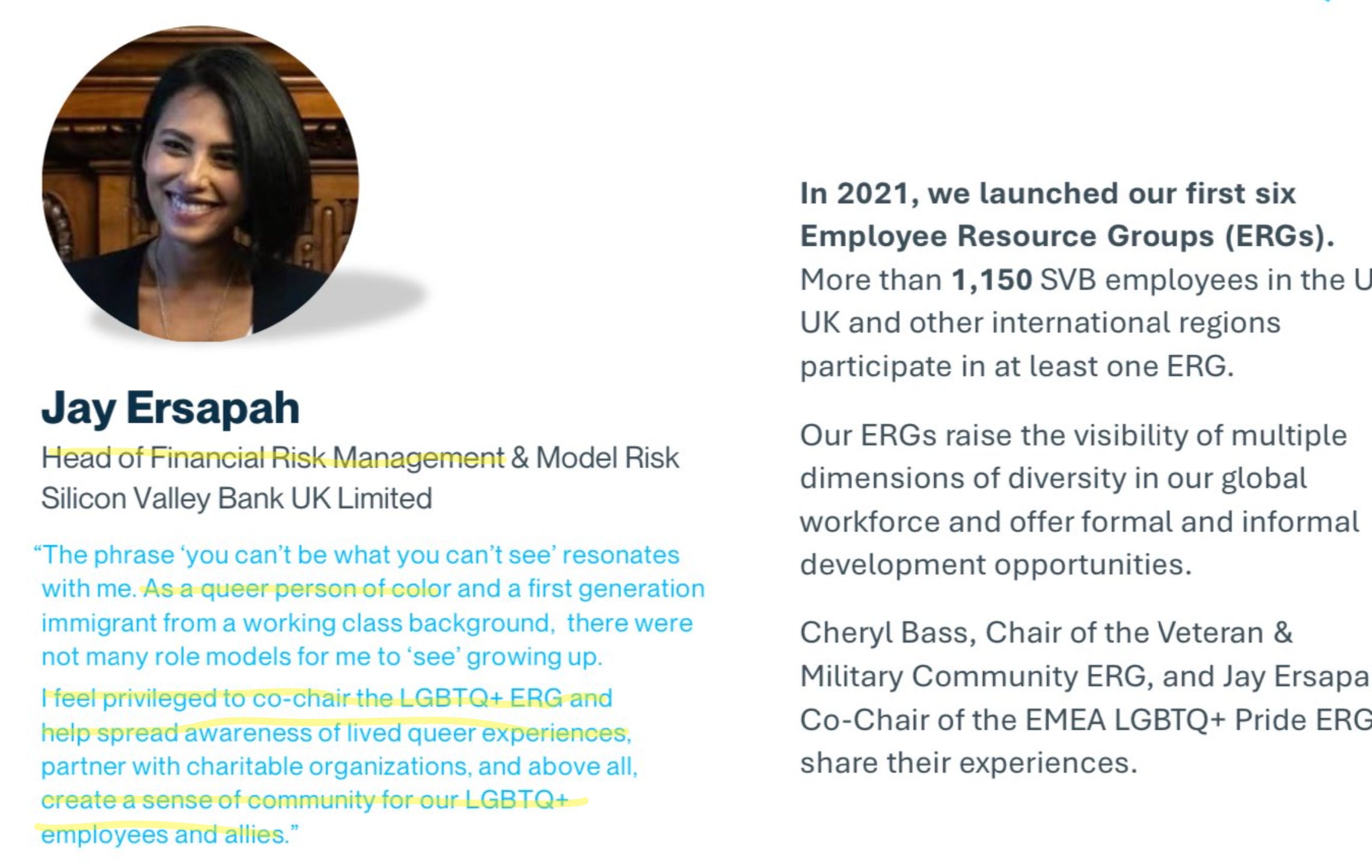

🔥 It didn’t take long to begin finding the diversity hires involved in the toppling of the first domino at Silicon Valley Bank, which pitched over faster than Mitch McConnell going down stairs at a swanky fund raiser. Meet Jay Ersapah, SVB’s queer diversity hire in charge of “Financial Risk Management.”

It looks like Ms. Ersapah was possibly more focused on sharing her queer sexual experiences than managing risk, but what do I know?

I know what you’re thinking. Ms. Ersapah might not have been qualified to manage risk for the bank, she had dark melanin, atypical sexual pursuits, and DIVERSITY EQUITY AND INCLUSION. Don’t be racist.

So.

🤡 Like in the Ukraine “war,” the more government officials continued “helping” the situation this weekend, the worse it got for normal folks. The Treasury Department snappily minted a new acronym program, the Bank Term Funding Program (BTFP), which lets banks borrow billions against their bad investments, by giving banks full credit for worthless assets “at par,” meaning the government will accept whatever the BANK says the assets are worth, not the market value:

The financing will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

Of COURSE, the Treasure Department “estimated” that there will be no immediate need for these government “loans,” because markets are solid, and no cost to taxpayers, because of unicorns and leprechauns, whereas independent analysts project of TWO TRILLION DOLLARS in the SHORT TERM.

The Wall Street Journal said the failing banks had been stable, until the Treasury Department recently began jacking interest rates:

Many of those [banking] securities have fallen in value as the Fed has raised interest rates. The [BTFP’s] terms would allow banks to borrow at 100 cents on the dollar for securities trading potentially well below that value, potentially putting the government at risk of losses incurred by banks. Critics said the move would essentially offer a backdoor subsidy to bank investors and management for failing to properly manage interest-rate risks.

“Potentially” putting the government at risk. Uh huh. Well, you can’t make an omelet without breaking a few eggs, what are a few banks between friends when we have to Reset the Globe:

“If this is limited to a relatively few number of banks and the underlying problem is not innate in the economy like it was during the global financial crisis, then I don’t think there is a strong case for the Fed to stop hiking,” said [William Dudley, who served as president of the New York Fed from 2009 to 2018.]

To be clear, here’s a recap of the government-fueled disaster flow chart, which comes right from the pits of Hell:

1. Feds keep interest rates historically low for twenty years straight

2. Banks adjust by buying lots of assets that do well when rates are low

3. Feds suddenly and unexpectedly jack interest rates faster than anyone thought possible

4. Bank assets instantly lose tons of value

5. Banks start failing

6. Feds just print more money and keep raising rates…?

It’s okay! It’s just another problem demanding a solution! What solution? Why, more and tighter regulation, of course:

“I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again,” President Biden said in a statement.

Nothing could go wrong with that plan. The brilliant former vice-president spoke to press this morning at 9am to address the banking crisis with a few minutes of brief, generalized comments. Despite having a terrific opportunity to reassure everyone, Biden took no questions and stiff-legged it out of the briefing room, for some reason:

At times like these, one soberly contemplates Obama’s prophetic 2020 assessment, “Don’t underestimate Joe’s ability to f— things up.”

📉 The stock market anxiously halted trading of over thirty bank stocks this morning — including financial giant Charles Schwab Investments — after West Alliance Bancorp shares dropped by a record 75% at the open. That wasn’t all:

First Republic Bank down 66%

Customers Bancorp down 54%

PacWest down 46%

Zions Bancorp down 44%

Bank of Hawaii down 42%

Comerica down 39%

EW Bancorp down 32%

At this morning’s press conference, Joe Biden reassured everyone that the market is strong, the bank sector is solid, and there is no reason to be concerned, so you know there must be blood in the financial streets.

💉 In pharmaceutical news, the Wall Street Journal ran a story yesterday headlined, “Pfizer Agrees to Buy Seagen for $43 Billion.”

Forty-three billion! Ironically, that’s what Twitter cost. Pfizer must have REALLY wanted that company. Totally coincidentally, Seagen holds a desirable portfolio of “pioneering class of targeted cancer drugs” designed for use when other cancer treatments fail. Pfizer’s president appears desperately focused on cancer these days, for some reason:

“Oncology continues to be the largest growth driver in global medicine, and this acquisition will enhance Pfizer’s position in this important space and contribute meaningfully to the achievement of Pfizer’s near- and long-term financial goals,” Chief Executive Albert Bourla said.

In other words, cancer-related treatments will “contribute meaningfully” to Pfizer’s NEAR-TERM financial goals. I wonder what those could near-term concerns might be?

💉 Pathologist Dr. Ryan Cole recently stressed, “don’t shoot the messenger,” and described what can only be seen as a pandemic of new cancers:

Please don’t listen to Dr. Cole, he’s just a fringe pathologist and a kook. Oh wait, here are some Australian doctors talking about seeing the EXACT SAME THING in their practices, and using the term “turbo cancer,” which now appears to be mainstreaming, despite the best efforts of corporate media to bury the term.

One of the doctors in the clip said that, for his entire career until recently, only a SMALL percentage of his new cancer patients would be at Stage 4. But since the vaccines, TWO THIRDS of his patients are already at Stage 4.

Two-thirds. And that’s not all. The Stage 4 cancers are worse than before:

“The tumors are bigger than ever, they seem to grow very aggressively, spread very aggressively, and be very resistant to treatment. This is being nicknamed ‘turbo cancer.’”

He also said that patients whose cancers were safely in remission are now suddenly and unexpectedly “flaring up.”

It’s probably all anecdotal though. Trust the science.

💉 Last week, “legendary” South African radio and TV presenter Mark Pilgrim, 53, succumbed to a sudden and unexpected Stage 4 turbo lung cancer.

The good news is that Mark was convinced of the value of the safe and effective covid vaccines, and he believed the government that the jab would keep him from getting sick. Mark even got his first jab AFTER he had covid:

Thanks, vaccine team!

Mark was diagnosed with a sudden and unexpected Stage 4 lung cancer in March 2022. By June, it had rapidly spread to his femur, the base of his spine, and his lymph nodes. He pursued aggressive cancer treatment. In September, his lung collapsed. In October and November, the previously-healthy journalist had multiple medical procedures trying to fix his collapsed lung. Sadly, he succumbed last week, despite excellent medical care, just a year after his initial diagnosis.

Pilgrim is survived by his two daughters, Tayla-Jean, 12 and Alyssa, 10, his ex-wife Nicole Torres, and his fiancée Adrienne Watkins, who are all comforted by Mark’s enduring faith in government-subsidized medical care.

💉 Last week, the Daily Mail UK ran a story about a 24-year-old English teacher from Yorkshire, Mollie Mulharon, who just got a sudden and unexpected turbo non-Hodgkins lymphoma cancer diagnosis, after being gaslit by her doctors who told her she was just imagining things and to quit bothering them with her hypochondriac nonsense:

So it turns out that the reason Mollie kept collapsing was not hypochondria but was because she was repeatedly having heart attacks caused by a 15 centimeter tumor pressing on her heart and lungs. So.

We pray for a better outcome for Mollie than these other cases, that she would be completely healed from her aggressive Stage 4 turbo cancer.

💉 Japanese volleyball star Naonobu Fujii, 31, died Friday from a sudden and unexpected stomach cancer.

Fujii was diagnosed with Stage 4 gastric cancer in February of last year, and the cancer quickly spread to his brain. Despite aggressive treatment, Fujii’s cancer finally got the better of him and he expired on March 10th. Fujii is survived by his wife, Miya Sato, another volleyball star, who he married a few months before his diagnosis.

You could say that some baffling, mysterious, unknown factor spiked the popular volleyball player and he lost the game of life.

🔥 The last time President Trump was in office, the Middle East was coalescing around Israel under American leadership, the economy was booming, and our military operations were dialing down with no Proxy Wars or major conflicts.

Well, a couple years later, we are looking at a pretty full plate now, aren’t we?

There’s plenty of good news buried under the media hysteria. As many folks have pointed out, the hearings in the House Committee on the Weaponization of the Federal Government have highlighted a stark contrast between the democrat and Republican committee members. Unable to stage-manage the proceedings, the democrats appear ill-prepared, poorly-informed, and unable to grasp basic ideas that really aren’t that complicated.

In other words, the democrats are being exposed as incompetent, very unlike the democrat lawmakers who undermined the country during the Cold War; they were sinisterly competent.

Anyway, it’s a lot easier to win when your opponents are incompetent and self-deluded, unable to explain the difference between a man and a woman.

More tangibly, red states and red counties in blue states are experiencing a political renaissance that would have been impossible if not for the overreaching efforts of the current Administration. Common sense is beginning to re-assert itself in our state houses, our court houses, and many of our churches.

Over the last three years, I’ve often asked people to try to imagine what would have to happen in order to “fix” Washington, DC. There never any ready answer; people don’t know. In fact, their brains usually short-circuit trying to imagine a solution that seems, well, unimaginable. It is literally mind-boggling and they usually give up, sighing that a fix is impossible.

But there IS an answer. I don’t know what it looks like exactly, but it will surely involve major political surgery, a transition back to reality that is serious, disruptive, and life-changing. In other words, the only way out is THROUGH. There’s not really any choice. For years, we’ve been putting off a lot of reckoning and now it is finally time to grapple with the problems.

Always be of good cheer! They want us fearful and depressed, so that’s the best reason to stay optimistic. But remember: we already bested the dark days of covid totalitarianism, and we’ll win this next part, too. I’m not saying it won’t take massive effort or there won’t be casualties, but what else would you expect of Fifth Generation Warfare and World War III?

When one falls, we close ranks and move forward.

In the meantime, we can prepare for the worst and hope for the best. I’ll have a lot more to say about all this as we push through the rest of the year. Hang on! There’s a reset coming; but it just might not be the reset that they had in mind.

Have a magnificent Monday, and I’ll see you back here tomorrow for the next installment.

Join C&C in moving the needle and changing minds. I could use your help getting the truth out and spreading optimism and hope, if you can: https://www.coffeeandcovid.com/p/-learn-how-to-get-involved-

Twitter: @jchilders98.

Truth Social: @jchilders98.

MeWe: mewe.com/i/coffee_and_covid.

C&C Swag! www.shopcoffeeandcovid.com

Emailed Daily Newsletter: https://www.coffeeandcovid.com

Leave a Reply

You must be logged in to post a comment.