Inside Mayor Adams’ migrant debit card boondoggle — no-bid bank gets $50 million, border crossers up to $10,000 each

February 27 | Posted by mrossol | Big Govt, Crazy, Democrat Party, Illegal Aliens, Stupidity, The LeftPeople keep voting for this kind of politician. mrossol

Editor’s note: After this column was published, the city’s Housing Preservation & Development, which had failed to respond to questions for days, reached out to The Post. The agency’s primary objection is that it claims the $53 million contract includes the money given to migrants and not just the fees for Mobility Capital. Though the contract itself includes fee provisions for spending more than $150 million (far above what HPD claims will be spent) the column has been updated to reflect HPD’s comments.

It takes money to make money, as the old saying goes, and apparently, it also takes money to give money away.

Earlier this month, The Post broke the story that Mayor Eric Adams is giving out pre-paid cash cards to migrants.

Unusually for the mayor, Adams didn’t publicize this story himself, and his administration for nearly a month has failed to correct several public misperceptions about it.

One misperception is that the program allows the city to give out just $50 million to migrants.

No wonder the mayor has been reticent.

This debit card program — if you read the actual contract — has the potential to become an open-ended, multibillion-dollar Bermuda Triangle of disappearing, untraceable cash, used for any purpose.

It will give migrants up to $10,000 each in taxpayer money with no ID check, no restrictions and no fraud control. (HPD later provided actual amounts to The Post, saying a family of four would be given $15,000 a year).

Why give out debit cards?

When The Post exposed the mayor’s debit card program earlier this month, the mayor’s office spun it as a money-saving program, to solve a problem: Migrants staying in hotels don’t eat all their food.

DocGo, the city’s no-bid “emergency” contractor to provide migrants with three meals a day, throws away up to 5,000 meals daily, wasting $7.2 million a year.

Some food is inedible — expired or rotten — and other food doesn’t meet migrants’ dietary needs.

Providing mass-scale meals competently and with options for specific needs — halal, kosher, vegan, non-gluten — isn’t that hard: The school system does it, airlines do it, hospitals and jails do it.

It wouldn’t be that difficult for the city to solve this problem: On-site city auditors could refuse to pay for meals that are objectively inedible, with visible mold, for example, or with expired labeling.

Instead of assuring that its existing no-bid “emergency” contractor fulfills its duty to provide edible food, however, the Adams administration has solved its problem by retaining a new no-bid “emergency” contractor — to provide a service with far more scope for waste, fraud and abuse than stale sandwiches: giving out potentially billions of dollars of hard cash, few questions asked.

Which vendors did the city’s Housing Preservation & Development consider for this contract, as qualified to provide this complex financial service?

New York City is home to hundreds of top-tier financial services and public benefits providers, a dream of a competitive bidding pool, to ensure that the city gets a good price, as well as strong protections against fraud and abuse.

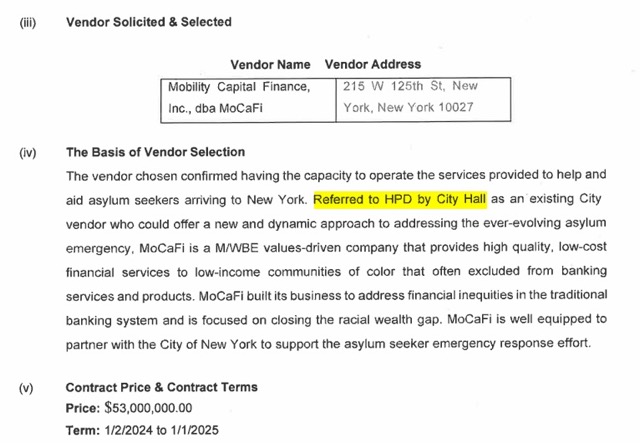

But HPD considered only one: Newark-based Mobility Capital Finance, which also has an office in Harlem.

MoCaFi was founded by Wole Coaxum, a former managing director at JPMorgan Chase, who said the death of Michael Brown in Ferguson, Mo., in 2014 inspired him to serve the “underbanked” and “narrow the racial wealth gap.”

How did HPD choose Mobility Capital? The contract makes it quite clear: MoCaFi was “referred to HPD by City Hall.”

What kind of experience did MoCaFi bring to this complex endeavor?

None. As HPD helpfully notes, on a “listing of prior/related emergency large contracts,” MoCaFi is “a new provider of emergency services for HPD.”

MoCaFi’s only city experience, HPD notes, is small-scale support of the city’s participatory budget program.

The company’s broader nationwide experience is as a “platform” for pre-paid third-party debit cards and bank accounts, marketed to minorities.

Where did City Hall find MoCaFi?

The only clue is from a stray off-the-cuff comment Adams made at a reception earlier this month, calling MoCaFi a minority business “that we met on the campaign trail … Little did we know that God is going to say, ‘There’s going to be a crisis, you’re going to have to meet them’ … And it’s going to cost us money” to “put investment … in our community.”

A year ago, the Adams administration was already eager to find something for MoCaFi to do.

Last year, the director of the mayor’s fund to advance New York City — a slush fund powered by anonymous private donors — raised at one of the fund’s board meetings the concept of “an upcoming partnership with the mayor’s office … and MoCaFi … on a universal basic income project”: that is, giving poorer New Yorkers (not migrants) cash.

Coaxum seems to have become part of the mayor’s orbit, and even provided a quote to an official City Hall press release praising Adams’ founding of a new “Office of Engagement.”

How much city cash will MoCaFi give out — and how much will MoCaFi be paid?

Since doing its migrant deal with MoCaFi, Adams has been content to allow a public misperception: that this program is small and focused, with 500 migrant families at the Roosevelt Hotel receiving debit cards of about $1,000 a month, allowing them to buy necessities at grocery and convenience stores.

As the mayor said in February in response to a press question, “We’re doing on a pilot project with 500 people.”

It’s easy to conclude — and the mayor has not disabused anyone of this thought — that that’s how this will all cost $53 million or thereabouts, the headline figure reported in the press.

Nope. A thousand dollars a month for 500 families for a year — a good time frame for a pilot — would cost $6 million.

The city could have written and signed a contract for about that amount — a contract that allowed for a well-defined pilot program with such well-defined costs, and a way to judge its results.

That’s not the contract the city signed — at all.

As the contract document clearly and explicitly states, over the year’s term, “in exchange for [MoCaFi’s] … performance of the services, the city shall pay to the contractor a total amount not to exceed $53 [million] … in accordance with the scope of services and fees.”

That “scope of services” does not include the money that the migrants actually receive on their debit cards.

The city funds the cards — that is, puts money on them — separately.

In other words: MoCaFi issues blank Mastercards, in bulk.

That’s it.

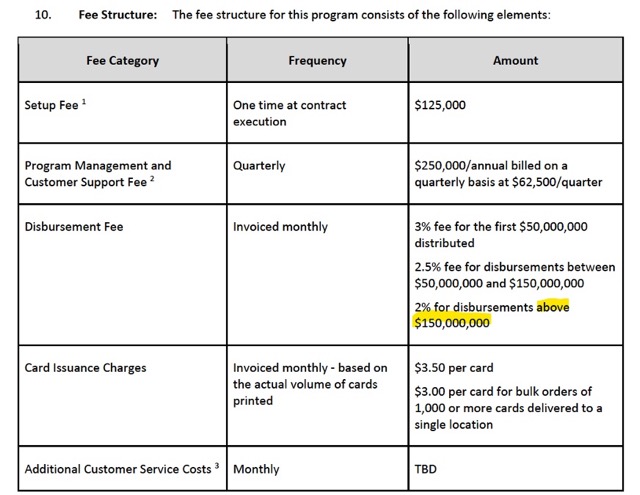

And for the “service” provided, MoCaFi not only makes money from each card distributed, but gets a 3% fee on the first $50 million the city puts on the cards — that is, $1.5 million. That fee drops, but only slightly, after that first $50 million.

Fraud controls … what fraud controls?

So, to sum up so far, the Adams administration, with no oversight, no consultation with the city council, and no public discussion, has given itself the flexibility to launch a massive parallel benefits program, alongside — not replacing — traditional welfare cash assistance and (for New Yorkers legally in the country long-term) federal food stamp benefits.

But those traditional programs, at least, come with reasonable, if not fail-safe, fraud protections. People must prove eligibility for these programs, including providing identification.

SNAP food stamp cards are not debit cards. They’re programmed only to pay for specific food items.

Adams’ potential multibillion-dollar debit card program, by contrast, has no such built-in protections.

As the contract with MoCaFi clearly notes, “cardholders will not be subject to ID verification,” and “the city shall be responsible for the accurate delivery” of cards to “consumers.”

And, “after delivery of [cards] to the city, the city shall be responsible for the security of the [cards] until delivered … to the cardholders.”

Under the contract, upon request by the city, MoCaFi will simply dump off hundreds, or more, of blank debit cards with no one’s name on them, with unknown amounts of money to be loaded on them — up to “$10,000 per card” at any one time — by the city.

The city may even issue debit cards to children: “if [cards] are to be distributed to any person under the age of 18 … the city … shall confirm that the minor cardholder’s parent or guardian has consented to the minor’s acceptance and use of the card.”

So, city employees and shelter contract workers are going to be in charge of handing out cards to be loaded and regularly refilled with untraceable cash, to people who have no forms of identity acceptable to the American financial services system, under a program with no eligibility or verification policy.

What could go wrong?

To list one potential problem among many, gang members will know that people staying in adjacent rooms, including vulnerable women and minor children, are in possession of these debit cards.

And potential card recipients will quickly learn who is in a position to make the decision of whether they can get a card.

Nor can the city ensure that recipients don’t spend the money on unauthorized products, or simply withdraw the money in cash.

These are not SNAP cards; they are Mastercards. “Cardholders can pay for any goods/services at any business merchant that accepts Mastercard,” the contract reads — restrictions are optional.

Yes, the city can ask MoCaFi to activate or deactivate certain merchant or spending codes.

But these restrictions are not built into the contract; they are at the city’s changing discretion.

The city can even enable cardholder “consumers” to withdraw cash from the cards at domestic and international ATMs. “ATM withdrawal amounts per day can be restricted as required by the city,” the contract reads. “Should ATM access be included as part of the program, card fees will be subject to the schedule provided.”

Why bother to lay out a fee structure for international ATM withdrawals, if the city knows it will never allow such withdrawals? Under what possible circumstance would the city need this flexibility built into a year-long pilot?

Fiction from fine print

As the mayor told radio host Gary Byrd earlier this month, “it’s important for us to speak directly to you to separate the facts from fiction … Fact from fiction is the migrant cards that we gave out to migrants to purchase food. Just some quick bullets that you need to know about these cards. They are not American Express gold cards, folks. This is a pilot project we’re doing with 500 migrants.”

The fiction is in what the mayor says.

The fact is in the contract documents.

The city has given itself the full contractual and technical authority, under a supposed “emergency,” to disburse billions of dollars in cash to unidentifiable people who otherwise are not eligible to access the American financial system, in untraceable global cash.

Nicole Gelinas is a contributing editor to the Manhattan Institute’s City Journal.